Salman bin Abdoel Aziz al-Saoed, sedert januari 2015 koning van Saoedi-Arabië.

De halvering van de olieprijs vormt een bedreiging voor mondiale en regionale rol Saoedi Arabië. Decennialang speelde Saoedi Arabië een sleutelrol op de mondiale energiemarkt. Door zijn grote olie– en financiële reserves kon het de rol van ‘residual supplier’ spelen en een beslissende invloed uitoefenen op de olieprijs op de internationale markten. Werd deze te laag, dan werd de oliekraan wat verder dichtgedraaid en kon de prijs zich herstellen. Werd deze te hoog, waardoor nieuwe aanbieders naar de markt werden gelokt en Saoedi-Arabië zijn dominante marktpositie dreigde te verliezen, dan werd de oliekraan wat verder opengezet.

Dat was onlangs het geval toen de productie van Amerikaanse schalieolie en –gas een grote vlucht nam. Daarmee wilde Saoedi–Arabië deze concurrentie onschadelijk maken in de veronderstelling dat zij bij een prijsniveau van zo’n $ 50 per vat niet meer winstgevend zou kunnen produceren en de productie zou moeten staken. Daarna zou de prijs zich weer herstellen – althans zo was de verwachting.

Maar thans lijkt het erop dat Saoedi–Arabië zijn hand heeft overspeeld. Dank zij de oplopende leercurve en de invloed van snelle technologische innovatie kunnen vele ‘frackers’ ook bij het huidige prijsniveau nog winst maken.

Onder de titel, ‘Saudi Arabia may go broke before the US oil industry buckles’, rapporteerde Ambrose Evans-Pritchard in de Britse ‘Telegraph’:

If the oil futures market is correct, Saudi Arabia will start running into trouble within two years. It will be in existential crisis by the end of the decade.

The contract price of US crude oil for delivery in December 2020 is currently $62.05, implying a drastic change in the economic landscape for the Middle East and the petro-rentier states.

The Saudis took a huge gamble last November when they stopped supporting prices and opted instead to flood the market and drive out rivals, boosting their own output to 10.6m barrels a day (b/d) into the teeth of the downturn.

Bank of America says OPEC is now “effectively dissolved”. The cartel might as well shut down its offices in Vienna to save money. …

By causing the oil price to crash, the Saudis and their Gulf allies have certainly killed off prospects for a raft of high-cost ventures in the Russian Arctic, the Gulf of Mexico, the deep waters of the mid-Atlantic, and the Canadian tar sands. …

Maar naar verwachting zullen vele ‘frackers’ het overleven, mede dank zij aanzienlijke recente productiviteitsverbeteringen.

OPEC now faces a permanent headwind. Each rise in price will be capped by a surge in US output. The only constraint is the scale of US reserves that can be extracted at mid-cost, and these may be bigger than originally supposed, not to mention the parallel possibilities in Argentina and Australia, or the possibility for “clean fracking” in China as plasma pulse technology cuts water needs.

Vele oliestaten zijn voor hun begroting afhankelijk van olie–export.

Saudi Arabia is effectively beached. It relies on oil for 90pc of its budget revenues. There is no other industry to speak of, a full fifty years after the oil bonanza began. …

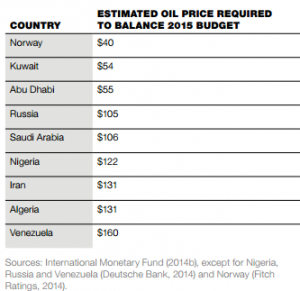

The International Monetary Fund estimates that the budget deficit will reach 20pc of GDP this year, or roughly $140bn. The ‘fiscal break-even price’ is $106.

Money began to leak out of Saudi Arabia after the Arab Spring, with net capital outflows reaching 8pc of GDP annually even before the oil price crash. The country has since been burning through its foreign reserves at a vertiginous pace.

The reserves peaked at $737bn in August of 2014. They dropped to $672 in May. At current prices they are falling by at least $12bn a month. …

OPEC have left matters too late, though perhaps there is little they could have done to combat the advances of American technology. In hindsight, it was a strategic error to hold prices so high, for so long, allowing shale frackers – and the solar industry – to come of age. The genie cannot be put back in the bottle.

The Saudis are now trapped. Even if they could do a deal with Russia and orchestrate a cut in output to boost prices – far from clear – they might merely gain a few more years of high income at the cost of bringing forward more shale production later on. Yet on the current course their reserves may be down to $200bn by the end of 2018. The markets will react long before this, seeing the writing on the wall. Capital flight will accelerate.

The government can slash investment spending for a while – as it did in the mid-1980s – but in the end it must face draconian austerity. It cannot afford to prop up Egypt and maintain an exorbitant political patronage machine across the Sunni world.

Social spending is the glue that holds together a medieval Wahhabi regime at a time of fermenting unrest among the Shia minority of the Eastern Province, pin-prick terrorist attacks from ISIS, and blowback from the invasion of Yemen.

Diplomatic spending is what underpins the Saudi sphere of influence in a Middle East suffering its own version of Europe’s Thirty Year War, and still reeling from the after-shocks of a crushed Saudi Arabia may go broke before the US oil industry buckles.

It is too late for OPEC to stop the shale revolution. The cartel faces the prospect of surging US output whenever oil prices rise.

Lees verder hier.

Voor de energieverbruikers is dit wellicht een prettig vooruitzicht. Maar voor de politieke stabiliteit in de Arabische wereld en vele andere olieproducerende landen is dit slecht nieuws.

Voor mijn eerdere bijdragen over klimaat en aanverwante zaken zie hier, hier, hier, hier en hier.

Voor de zogenaamde energiecrisis in 1973 schommelde de prijs van een barrel olie altijd rond de $ 25 en vanaf die tijd is de prijs flink omhoog gegaan tot $ 110 aan toe.

Door olie producerende criminelen zijn we nu al zo’n 42 jaar opgelicht middels veel en veel te hoge olieprijzen.

Dat ze nu in financiële problemen zouden komen is niets minder dan enige rechtvaardigheid, want in de afgelopen 42 jaar hebben ze onvoorstelbare bedragen aan deze oplichterij opgestreken.

Snel deze oplichters opruimen en wegbergen en gezond verstand z’n werk laten doen!

Ook Royal Shell heeft in niet mis te verstane mate van deze praktijken geprofiteerd. Nu de slagroom niet meer metersdik op de taart zit en onverhoopt de waanzinnige winsten van Shell een beetje teruglopen begint Shell maar snel 6400 mensen te ontslaan want de (groot-)aandeelhouders moeten immers tevreden gehouden worden!

Ook hier is het niets minder dan rechtvaardig dat na vele jaren van prijs-uitbuiting er eens aanzienlijk minder slagroom op de taart zit.

Let wel: Er is absoluut nog geen enkele reden om ook maar enige medelijden met dit soort bedrijven te hebben want ze barsten werkelijk van het geld.

Degene die mij een negatief duimpje heeft gegeven:

Het is een grootaandeelhouder van Shell of iemand die werkelijk totaal niets begrijpt van de (historische) energieprijsontwikkeling.

Iemand die dus meer dividend ontvangt van Shell dan de gigantische bedragen die dezelfde persoon de afgelopen 42 jaar teveel voor allerlei vormen van energie heeft betaald of een totale onbenul op het vlak van de samenhang van energieprijzen.

Ik begrijp uw reactie niet zo goed Ron. Shell is als bedrijf toch geen eigenaar van de bodemvoorraad ? Volgens mij maakt het voor Shell dan ook weinig uit dat de prijs van een vat olie is. Zij maakt winst door olie te raffineren en verkoopt die producten. Het maakt daarbij dan toch niet uit of de prijs van de grondstof nou 55 dollar of 110 dollar per vat is. Wat Shell doet is er bijvoorbeeld een liter benzine van maken en bij verkoop maakt ze een dubbeltje winst. Dat kan ze gewoon blijven doen, het maakt daarbij niet uit of de prijs van een vat olie nou onder de 10 dollar ligt of boven de 250 dollar.

Als je naar Shell Pernis kijkt maakt Shell al jaren GEEN winst met olie raffineren. Hooguit break even/verlies. En dat geldt voor heel Europa waar de raffinage verzadigd is. Vandaar ook de crisis nu bij Shell en NAM die Rob B. beschrijft. Zij wijten dit geheel aan de olie- en gasprijs.

Het ligt een beetje aan het contract dat Shell in het land heeft. In Irak, Nigeria en Rusland krijgen ze ook een percentage van de waarde van de opgepompte olie. Deze omzet is wel afhankelijk van de olieprijs.

In Irak is hetzelfs zo dat een basisprijs per vat olie naar de regering gaat en de rest is voor Shell. Ook is er een resultaat verplichting in termen van vaten per dag. Hier ligt het prijsrisico helemaal bij Shell.

@Marcel:

Je begrijpt mijn reactie niet zo goed….

Het lijkt erop dat je meer in deze materie naast mijn reactie niet zo goed begrijpt.

Shell wint in vele landen olie.

Als de prijs van de gewonnen olie er niet toe doet is dat een hele bijzonder economisch verschijnsel.

Dan doen de kosten van de winning er waarschijnlijk ook niet toe.

Ik ga het ook niet verder uitleggen.

“Saudi Arabia may go broke” is interessante suggestie. Saudi’s volgen een strategie van overvloed productie met als doel een prijzenoorlog en marktvolume behoud. Dat lukt inderdaad niet helemaal o.a. door de schaliegas boom in USA. Ook zal Saudi Arabia een strategie moeten gaan ontwikkelen van een interne economie “na de olievoorraden”. Is de situatie / uitzicht zo erg als wordt gesuggereerd? Saudi’s en Saudi Arabia zijn puissant rijk en zijn zeer grote geldschieters van wereldwijde Islam-belangen en Islam-promotie-groepen, en kunnen hun eigen bevolking met overmatige Islam-wetgeving en politie-pressie onderdrukken en dat alles zal wellicht “iets” moeten inboeten, de komende jaren. Maar gaan ze failliet? Wereldwijd hebben Saudi’s hun enorme bezittingen en beleggingen in vastgoed (Londen/Parijs/USA) en mega aandelen wereldwijd in de westerse technische industrie. Saudi’s fortuin is mega : https://en.wikipedia.org/wiki/House_of_Saud ; https://en.wikipedia.org/wiki/Economy_of_Saudi_Arabia

Alle oliemij`en verdienen heeft meest aan de zgn `upstream` activiteiten. M.a.w. het oppompen en verkopen van olie uit eigen of gedeeltelijk eigen velden. ‘Downstream’ is er veel minder te verdienen, vandaar dat de majors hier een terugtrekkende beweging maken en deze markt meer en meer aan de independents laten.

Hoge crude prijzen zijn dus een must voor de oliemij`en!

Lekker Pikettystisch praatje weer hierboven van Rob B. Kijk voor de lol een naar de samenstelling van de benzineprijs.

Ik blijf wel met een vraag zitten: Dat de Russen uit de markt geprijsd worden is in het belang van de VS maar of een verzwakking van de positie van de S. Arabieren dat ook is lijkt mij nog de vraag.

Enfin of het allemaal nog niet genoeg is, hebben we ook dit nog: http://www.geenstijl.nl/mt/archieven/2015/08/zelf_benzine_stoken_doe_je_zo.html#comments

@dwk:

Hoezo Pikettystisch praatje?

Heb je niet zelf ook last van hoge energieprijzen (olieprijs gerelateerd) en is de max prijs tot 1973 niet al meer dan 4 keer over de kop gegaan?

Reken voor de grap eens uit wat je dat de afgelopen 10-20-30 jaar heeft gekost!

Interne en geheime voorraadrapporten van Shell geven aan dat er voor de komende paar honderd jaar geen enkele schaarste is.

Het meest verdiend wordt er aan de niet feitelijke maar naar buiten toe gecommuniceerde zogenaamde schaarste en dat niet alleen op het gebied van fossiele brandstoffen.

Nogmaals, kijk eens naar de samenstelling van de benzineprijs.

Ik heb geen medelijden met Shell maar misgun ze ook de relatieve rijkdom niet. Het is als met farmaceuten: het geld wordt voor het leeuwendeel gebruikt voor verdere ontwikkeling. Elders werd o.a. door Theo Wolters en Richard Tol al betoogd dat de werkelijke assets van Shell bestaan uit technologische kennis en de capaciteit nieuwe technologieën te ontwikkelen. Het is vooral daarom dat ik het geld liever in de zak van een “olie”maatschappij zie dan op de rekening van Greenpeace want dat laatste is werkelijk een garantie dat de samenleving er nooit iets voor terug zal krijgen; tenzij je winterpenen trekken in je eigengebreide trui een aantrekkelijk vooruitzicht vindt.

@dwk:

“het geld wordt voor het leeuwendeel gebruikt voor verdere ontwikkeling”

Dat geloof je toch zelf niet echt hoop ik. Zie bijvoorbeeld de brandstoffen, is daar ook maar enige serieuze ontwikkeling in geweest???

Zo is het met een heel bescheiden toevoeging voor benzine en diesel mogelijk om zowel CO2 en NX dramatisch (minus 90%) te reduceren maar dat gebeurt niet omdat een “neveneffect” van die toevoeging is dat er zo’n 15% minderverbruik optreedt en dat zien ze niet graag.

Verder ontwikkelen ja voor producten waaraan ze dan flink kunnen gaan verdienen waarbij het verdienmodel geoptimaliseerd is en niet de optimalisatie voor milieu etc.

Nee, echt, het enige dat maximaal geoptimaliseerd is, is de winst.

En nee, het is geen theoretisch verhaaltje van een “verdwaalde” chemicus maar keiharde realiteit, door mij persoonlijk reeds jaren toegevoegd aan alle brandstof die ik verbruik.

Bron?

@Ivo:

Bron van wat?

Van de reductie CO2 & NX?

Eigen onderzoek van ruim 30 jaar aansluitend op de 1973 energiecrisis als chemicus.

Daarbij aansluitend op de brandstof die op de circuits wordt/werd gebruikt.

Bij elke APK keuring wordt er ineens getwijfeld of de gasmeter het nog wel goed doet vanwege de extreem lage waarden.

Rob, je boft. Mijn antwoord wordt niet geplaatst. Vraag de moderator.

Er is iets mis gegaan met de techniek.

Hier de reactie van DWK.

@Rob,

J E K L E T S T M A A R W A T.

Ik ben geen petrochemicus, maar het antwoord luidt JA: brandstoftechniek heeft een enorme ontwikkeling doorgemaakt. Ik heb geen zin om mezelf voor de zoveelste keer te herhalen: google ‘de woedende kok standbeeld voor shell’

En natuurlijk wordt dat geld ook gebruikt voor enorme bonussen. boehoehoe en nog ‘s boe! En natuurlijk moet een ojlkumpanie winst maken. Dat is een beetje het concept van kumpanies. Maar bedenk: zonder olie geen moderne geneeskunde om maar eens wat te nomen. Het geld komt uiteindelijk goed terecht.

Oh, en natuurlijk bedrijven ondernemers politiek en ontwikkelen ze ‘snode’ strategieën om de waarde van de onderneming overeind te houden en liefst te verhogen. Vandaar dat Shell niet op de achterste benen staat als Diederik weer eens roept dat de olie bijna op is. Vandaar dat Poetin ook stiekem wel blij is met die protesterende milieuvervuilers van Greenpeace. Vandaar ook dat Shell momenteel een lans breekt voor gas onder gebruikmaking van zogenaamde klimaatargumenten. Ze lopen daarin nl. voor op de concurrentie.

Het zijn inderdaad de olieboeren die de “verheffing van de verworpenen der aarde” effectief mogelijk hebben gemaakt ;-)

@Hans Labohm:

Ik heb een reactie geschreven op de door jou doorgegeven reactie van dwk, en daar gebeurt hetzelfde. Verzoeke ook mijn reactie boven water te hengelen.

Rob, zal ik Hans even vragen of hij je uit je hok laat?

Hier nog een linkje over de benzineprijs: http://www.geenstijl.nl/mt/archieven/2015/08/benzineprijs.html#comments

Wat een GreenPeace gezever om Shell (en oliemaatschappijen in algemeen) in het strafbankje te zetten. Het zijn raffinaderijen van brandstoffen. Van de benzine-/diesel-prijs gaat 64% naar de staatskas. Daar wordt complete “duurzame” gelul mee bekostigd.

Even iets anders en toch over hetzelfde.

De Billy’s van IKEA kappen in september met de verkoop van alle lampen behalve LED.

Vinden zij goed voor de consument. Deze beslissing is uiteraard genomen onder de loodzware druk der heersende opinies. En dus bij IKEA is de aarde in goede handen of zoiets.

Nu kan men zich afvragen waarom de EU met toestemming van ons nationale parlement indertijd onze keuzevrijheid waar het gaat om lampen zo drastisch inperkte (Hallo Phillips lobby!) maar wij gewoon door kunnen gaan met de aanschaf van auto’s als vandattem: http://ww3.autoscout24.nl/classified/253130899?asrc=st|as

Het antwoord luidt: omdat de overheid helemaal verslaafd is aan uw geld.

Bij Kwantum kan je oude voorraden gloeilampen kopen, bij de Action ook. Huisvoorraad is weer op niveau!

Heb in mijn nieuwe appartement alleen maar LED lampen, mijn energie rekening is dan ook lekker laag.

Snap niet dat je die ouderwetse rommel nog in huis wil hebben

17 euro voor een dimbare led-lamp. Je bent gek man. Plus je laat je pressen door die klimaat-idioot van een Jacqueline Kramer/Cramer.

0,56 cent voor 60 watt lamp melk wit, voor gezellig licht .

Beste Janos73,

technologisch gezien is het inderdaad oude rommel. Maar het werkt wel en heeft zijn betrouwbaarheid al ruimschoots bewezen. Die Led lampen moeten dat nog doen. Inderdaad, de Led chips zelf gaan heel lang mee. Dat is zo en is goed. Maar het gaat om de tussenliggende electronica. Uiteindelijk zal de voeding ergens uit 240 volt 50 Hz AC moeten komen. Een Led eet 3 volt, DC, en heeft een heel vervelende V/I curve, die er toe leidt dat sturing met constante spanning tot de verwoesting van je Led zal leiden. Er moet dus iets tussen dat 240 AC omzet in 3 Volt DC, met stroomsturing. Ideaal is natuurlijk vermogenssturing met temperatuur bewaking, en liefst met een rendement van 97% (waar heb ik die 97% eerder gezien?), en dat bij voorkeur in een standaard GU10 behuizing. Afvoer van warmte (Leds worden wel degelijk heel erg warm, itt wat algemeen geloofd wordt!) via koelsleufjes, hopende op voldoende lege ruimte achter het plafond. Resultaat: afhankelijk van de omstandigheden, houdt de electronica in zo’n duur lampje het voor gezien, lang voor dat de levensduur van de Led is bereikt. Als je geluk hebt en goede Leds gekocht hebt, brandt je huis niet af. Hoef je alleen het lampje te vervangen. En dan mag je hopen dat het vervangende lampje dezelfde kleurtemperatuur als de rest van de oude lampjes (geen kans, door veroudering verandert de kleurtemperatuur van je Leds) heeft, anders moet je ze eigenlijk allemaal door nieuwe vervangen. Lekker goedkoop, zo’n Led lamp.

Moet je eens kijken naar de prijs voor dimbare LED-kaarsjes voor kroonluchters. Hotelkamers verlichting op de gangen enz. Dan sta ik een jaar voor nop te koken.

Ik heb een jaar geleden alle linkse lectuur (ja mensen die had ik) uit mijn bibliotheek gepleurd en daarvoor in de plaats staat nu een onuitputtelijke voorraad ouderwets gloeiwerk.

Daarnaast; ik heb ooit één led-kaars gekocht om te proberen. Ik vond het onaangenaam licht. Dat schijnt nu beter te zijn. Maar goed; het lampje gaf na minder dan een maand de geest. Nu wil ik wel geloven dat dat pech was (hoewel, als ik nu dat verhaal van Henkie lees). Maar hoe administreer je dat? En hoe coulant zijn leveranciers als ze stuk gaan voordat het aantal “gegarandeerde” branduren is bereikt.

Maar weet je wie er wel erg blij mee zijn? http://www.loupiote.com/photos/18431283.shtml?s=435436 en Albanese boeren niet te vergeten. Die zijn er ook zeer meer in hun nopjes.

Ik moet opeens denken aan een Franse vrek die regelmatig bij mij aan de toog zat. Brandde er een peertje door dan draaide hij hem vliegensvlug los, schudde de lamp voorzichtig zodat de draad zichzelf weer vast soldeerde. Kon maar zo weer een maandje mee.

Als tegenprestatie tapte ik hem een verse schuimkraag. Je moet het niet te gek maken.

Mijn vrouw noemt mij niet voor niets Pierre Radin. Met een beetje ouderwetse zuinigheid is niets mis naar mijn mening.

Beste dwk,

die truuk ken ik ook, maar iets anders en dan werkt ie ook met lampen die al wat langer stuk zijn. Rond de voet van de lamp, op de overgang glas/metaal, zit meestal een smalle zone die helder is. Daar door heen kijkend kun je de defecte gloeidraad zien. Als die nog lang genoeg is om weer contact te kunnen maken met de andere pool, schroef je die lamp in een losse fitting met snoer, stekker in het stopcontact en dan met die lamp draaien, al kijkend door de zone, om er voor te zorgen dat het losse eind van de gloeidraad weer contact maakt met de andere pool. Als dat lukt, zie je een stevige blauwe vonk in de lamp, en gaat de lamp weer aan. Door de positieve weerstands- karakteristiek van de gloeidraad loopt er op het moment van contact maken ongeveer 5- tot 10-X de normale stroom door de koude gloeidraad, zodat de gloeidraad vastgelast wordt. En weer een kostbare lamp gered.

Beste Henkie,

Deze is een hele pils waard. Nu kan ik LEDloos honderd worden en wie wil dat nou niet.

Mijn moeder (98) kon mooi vertellen hoe ze bij haar thuis in het oude Indië voor het eerst elektrische verlichting kregen. De hele familie zat avonden met open mond naar dat peertje te staren.

Over twee jaar zitten mijn klanten net zo naar mijn kroonluchters te gluren. Waadisdaadaan? Nou da’s dus een gloeilamp, een prachtvinding om licht te maken uit een ver verleden. Gaat een leven lang mee.