Onder de titel, ‘Low oil prices are lasting a lot longer than petro-rulers thought they would’, schreef Steve LeVine voor Quartz:

A nightmare scenario may be unfolding for Russia and some OPEC members: Low oil prices, rather than being a fast way to hobble upstart US shale oil, seem likely to linger for quite a while longer, perhaps well into next year and beyond. If prices do stay in their current range of $45 to $55 per barrel—and a lot of analysts believe they will, if not fall even further—some of the world’s petro-rulers have tough decisions ahead to stave off serious political instability.

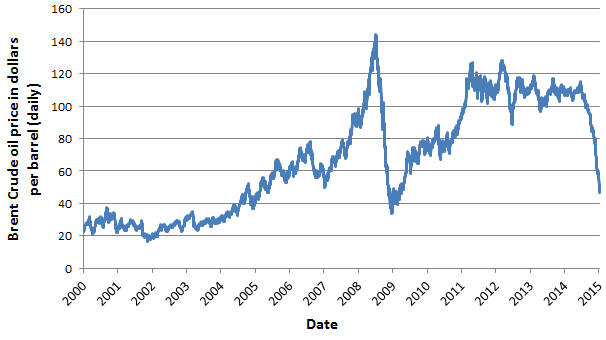

In early Asia trading today, internationally traded Brent benchmark futures were as low as $53.01 a barrel. As you see in the chart below, oil began its plummet some 13 months ago, when Brent futures peaked June 24, 2014, with a close at $112.60 a barrel. The slide picked up pace around the start of 2015 and reaching a new low Jan. 13, closing at $47.82 a barrel, a dizzying 57% plunge.

Dit is voor een belangrijk deel veroorzaakt door het exportbeleid van Saoedi Arabië. Het land beschikt over grote valutareserves en olievoorraden die tegen lage kosten kunnen worden gewonnen. Om zijn marktaandeel te beschermen en potentiële concurrenten de pas af te snijden, overspoelt het de markt met goedkope olie. Maar andere producenten kunnen zich deze luxe niet veroorloven. Vele niet–Arabische OPEC-landen zullen naar verwachting daaraan een zware dobber krijgen. Voor Rusland, dat naast lagere olie- en gasprijzen met westerse sancties wordt geconfronteerd, ziet de toekomst er somber uit. De olie- en gasovereenkomsten die het ter compensatie met China heeft gesloten, hebben tot dusver geen zichtbaar effect gehad.

Lees verder hier.

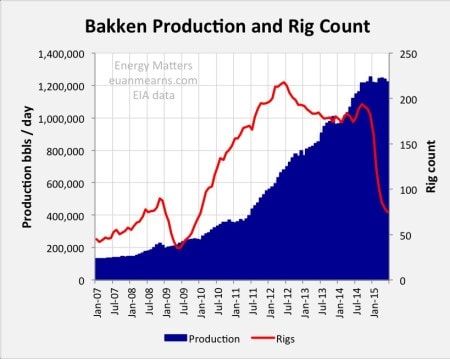

De lage olieprijzen vormen eveneens een uitdaging voor de Amerikaanse producenten van schalieolie en –gas. De algemene verwachting was dat velen van hen dit niet zouden overleven. Maar de schade is tot dusver beperkt gebleven. Het aantal boortorens is sterk gedaald, maar in sommige velden is de totale productie toch vrij constant gebleven.

Onder de titel, ‘Long-Predicted U.S. Shale Production Collapse May Not Materialize Yet’, rapporteerde Euan Mearns daarover het volgende:

The EIA drilling productivity report has been used to estimate decline rates in the Bakken, Eagle Ford and Permian light tight oil (LTO or shale) plays ….

The objective is to estimate how far production will fall in these plays in light of the sharp decline in US rig count. The rationale is to calculate the production level at which new oil production capacity added will cancel the declines and equilibrium is reached. The shale drilling industry is highly dynamic. While rig count has fallen by about 60% in the 3 plays since end 2014 this is in part offset by rig productivity that has more than doubled in recent years. The rig count decline has more recently stabilized. Improved productivity should help profitability, but this is cancelled by the collapse in oil price. …

It is questionable whether a decline in LTO production on this scale will be sufficient to bolster the flagging oil price and may, for example, be offset by production gains in Iran and elsewhere. Since much of the global oil industry cannot survive at current price levels a second and more brutal round of cuts to OECD companies is to be expected. This may in part take the form of company insolvencies that are just getting underway in the US shale industry. Ultimately, a balance between global oil supply and demand must be restored and, without a production cut by OPEC, this must then occur within the non-OPEC companies and countries. …

For each of the Bakken, Permian and Eagle Ford areas 5 standard charts have been produced. These charts are presented below with key observations and the discussion follows. …

Lees verder hier.

Ondertussen zijn de proefboringen van schaliegas in Engeland tot stilstand gekomen nadat de Raad van Lancashire daarover zijn veto heeft uitgesproken.

Onder de titel, ‘Fracking could be delayed for up to two years across UK after Lancashire council rejects test drilling’, schreef Oliver Wright in ‘The Independent’:

Setback for Government after shale gas company is banned from drilling eight wells on Lancashire coastal plain. Government plans to roll out fracking across Britain face delays of up to two years following a surprise decision to reject exploration for shale gas in Lancashire.

Ministers are concerned by the implications of the decision by Lancashire County Council last month to reject planning applications from the shale gas company Cuadrilla to drill eight wells at two sites on the Fylde coastal plain.

The Government had been expecting councilors to give their go-ahead to exploratory drilling on sites. But instead they turned down Cuadrilla’s application on the grounds that it would have an unacceptable visual impact and create too much noise.

Cuadrilla has now appealed but that process, regardless of the outcome, is likely to take 16 months. Senior Government sources said they feared other companies were now unlikely to submit further fracking applications – that were not already underway – until they saw the outcome in Lancashire.

A Government source said: “It is incredibly frustrating. These are temporary exploratory wells so how on earth Lancashire County Council can turn them down on the basis of visual impact makes no sense at all. “Cuadrilla has already spent millions on the process, and will now have to spend millions more on the appeal. “But the real problem is that until the industry knows what the outcome is in Lancashire, there is going to be a real reluctance to invest in other areas.”

The source added that getting fracking underway was one of the key objectives of the Government now the Conservatives were no longer in coalition with the Lib-Dems. “It is now a real priority for the Department for Energy and Climate Change,” they said.

Lees verder hier.

Al met al dienen we rekening te houden met blijvende onzekerheid over de toekomstige energiesituatie. Maar elk nadeel heb zijn voordeel. In tegenstelling tot eerdere periodes, wordt deze onzekerheid dit keer niet gevoed door een dreigend tekort aan fossiele brandstoffen, maar door een overschot. Dat betekent lagere prijzen. Dat is goed voor de consument en goed voor de economie. We moeten onze zegeningen tellen.

Voor mijn eerdere bijdragen over klimaat en aanverwante zaken zie hier, hier, hier, hier en hier.

Obama getuigt van weinig realisme? Nog meer dure energie, en dat in aanstaande presidentiele verkiezingsstrijd: http://www.washingtonpost.com/news/post-politics/wp/2015/08/03/president-delivers-impassioned-plug-for-his-clean-power-plan/

Na zo’n presidentiële verklaring kan je toch de dreigende klimaatverandering niet meer ontkennen? Kortom, als de klimaatwetenschap tot de ontdekking zou komen dat CO2 er weinig toe doet en waterdamp de temperatuur bepaalt dan kunnen ze dat niet publiceren. In één ding had Obama gelijk: soms is het te laat. Dan is er geen weg terug meer. Voor verdwazing geldt dat dus ook.

Hans, heb je ooit Wim Kan gezien? Over koning Faroek (?) die aan de deur komt leuren met een kan petroleum.

Wim,

Kan ik mij niet herinneren. Heb je een link?

nee, zal proberen te zoeken.

was trouwens koning Feisal.

Hans, geen beelden. wel tekst, bij bespreking CD2,

http://www.kkunst.com/kk/20031119342.php

Voor een land als Venezuela met zijn zwavelrijke zware olie die tegen een korting verkocht moet worden en alleen geraffineerd kan worden in speciale raffinaderijen zoals die op Curacao en in de PDVSA (Citgo) in de VS , speelt zich nu een economisch horror scenario af.

Dat land leefde van de olie inkomsten en had een 3e wereld verzorgingsstaat opgebouwd onder Hugo Chavez. Het land heeft nu immense schulden en kan zelfs noodzakelijke medicijnen en voedsel importen amper betalen. Haar valuta is in vrije val , met inflatie cijfers die nu boven de 100% per jaar komen. Je kunt daar nu sociale en politieke onrust voorspellen, met mogelijk politieke onderdrukking en instorting van de staatsinstituties, die opgebouwd werden onder de communist Chavez. Dat zou kunnen leiden tot burgeroorlogachtige toestanden. In feite zijn de criminaliteitscijfers van dat land zo hoog, dat ze zouden kunnen behoren bij het aantal slachtoffers van burgeroorlog (24k+ moorden op 30.8+ M inwoners/j stats 2014) . Het land verkoopt nu olieconcessies (Orinoco) aan China (27G$) die nooit revenuen zullen opleveren voor het land. Die zijn daarbij al verpand. Dit alles om maar aan geld te komen om te overleven. En het wordt steeds slechter , alle financiële reserves zijn opgebruikt. Het land begint een Cubaanse indruk te maken: alleen rijst, bonen en rijdende autowrakken, al is de benzine nog spotgoedkoop voor de burger daar.

**

http://www.theguardian.com/world/2014/jan/12/violent-crime-makes-venezuela-dangerous

**

http://www.washingtontimes.com/news/2012/mar/12/venezuelan-oil-a-risky-investment-for-china/?page=all

Venezuela. Tsja. Je kunt het een communistisch land noemen, of socialistisch. Het zijn loten van dezelfde stan. Maar elk land wat een dergelijk systeem hanteert is verdoemd. Het einde van het liedje is altijd dat andermans geld op is zoals Margaret Thatcher dat zo treffend wist te verwoorden. Waarna het land dus failliet is en het systeem implodeert.

Geen reden voor leedvermaak. We zijn met ons land en onze EU druk bezig om dezelfde weg af te leggen.

Geval Venezuela heeft ook wel (en vooral) “iets”.met het socialisme te maken. They’re out of other peoples money! Gebeurt hier ook als de verzameling (oud-)communisten te Brussel nog even zo door gaat.